A selection of projects

In addition to proprietary technological developments, Quantefakt has successfully carried out numerous projects on behalf of different customers since its foundation in 2000. Information about customer projects is greatly simplified and anonymized.

ETF - Arbitrage

- Development of a trading application for the implementation of a proprietary ETF proprietary trading strategy.

- Fair value calculation of US ETFs and their constituents, display of arbitrage opportunities and automated order generation as well as algos for building and reducing positions

- Clicktrader for manual processing of orders in illiquid securities

- Client: Small US hedge fund

Portfolio management system "Quantitative Funds"

- Refactoring Excelsheets to Implement Quantitative Investment Funds

- Test-driven, agile development of an object-oriented (C#) computing core for the storage of inventory data (ORM), implementation of the funds, overlay management, duration control and management of DTGs

- Implementation as an Excel plugin to maintain the spreadsheet look and feel

- Roll-out for approx. 100 investment funds

- Customer: Large German Asset Management Company

Co-location futures trading

- Enhancement of our proprietary trading application JATS2 to a fully decentralized trading platform based on AKKA

- Enhancement of JATS2 of risk management functionalities

- Solution with JATS2 strategy runners in co-location for futures trading

- Client: Canadian pension fund

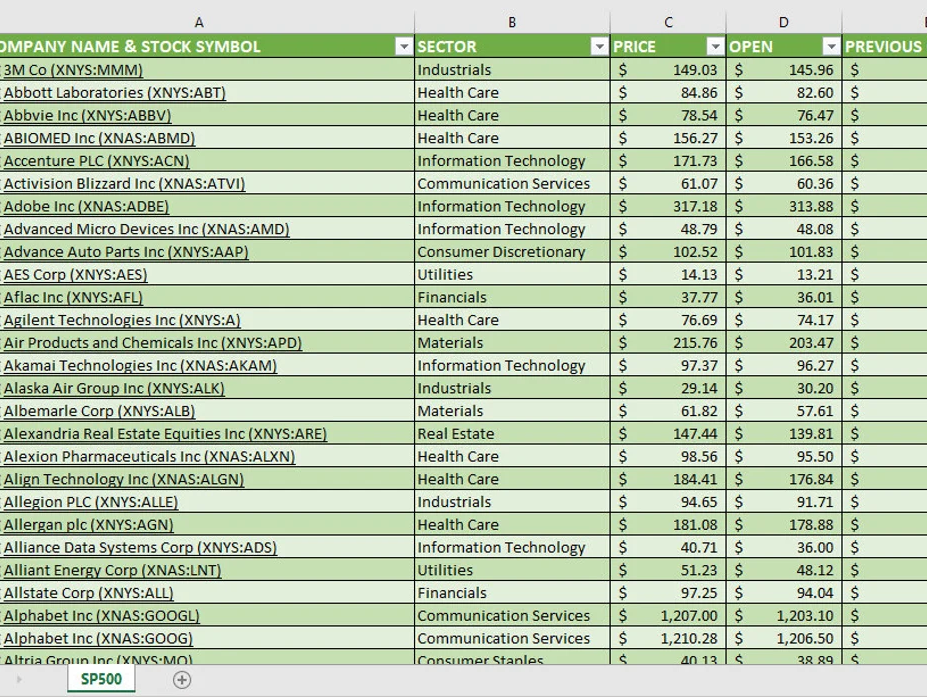

AI strategies based on Reinforcement Learning

- Development of long-short and long-only trading strategies for the S&P 500 based on our in-house AI library (Reinforcement Learning)

- Development of an intraday trading strategy for the XBTUSD perpetual contract at BitMEX based on our Reinforcement Learner

- Proprietary trading strategy